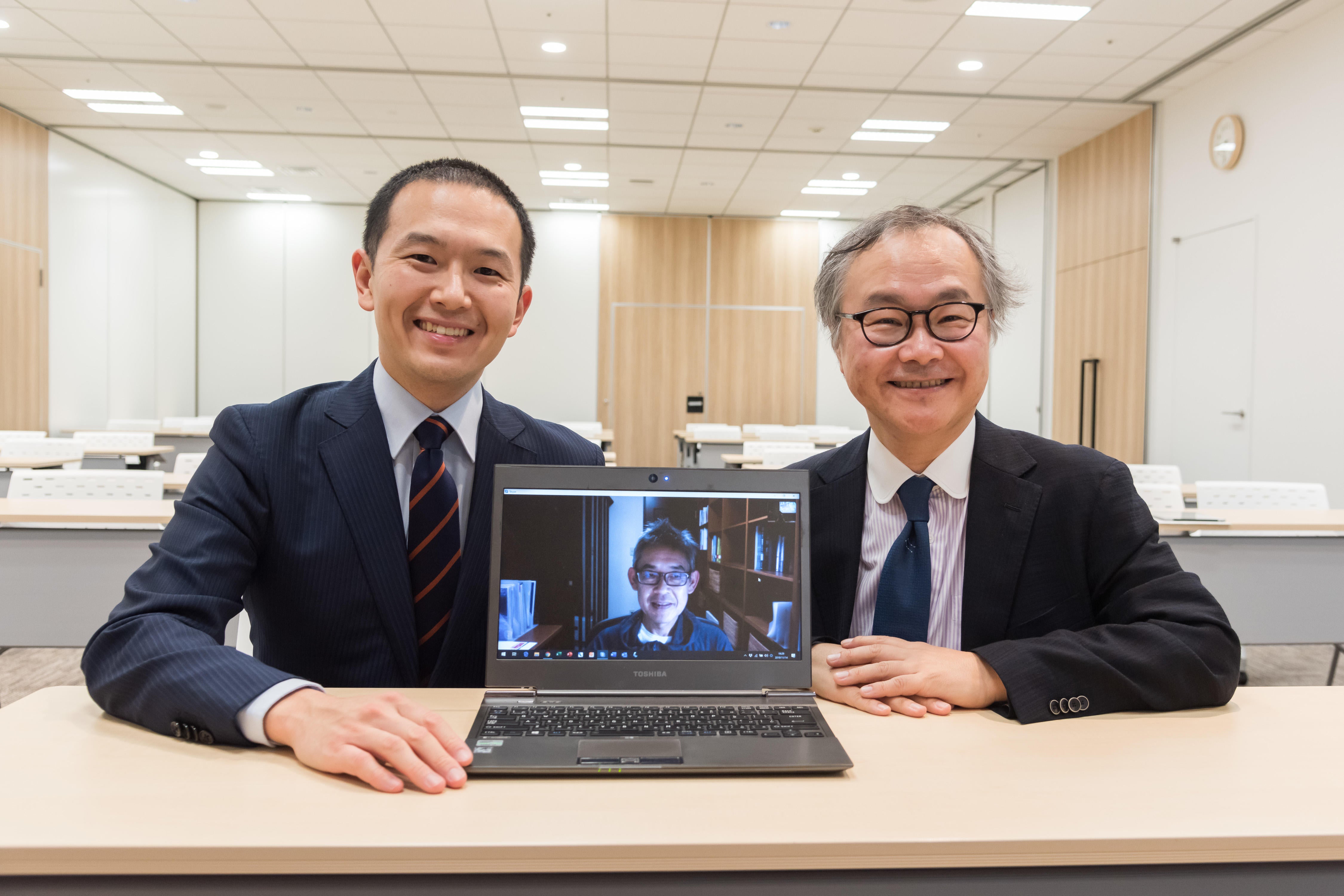

Akihiko Shimauchi (left), INDEE Medical advisor (founder)

Shingo Tsuda (right), INDEE Japan president and technical director

ReCell is a burn treatment device developed by an Australian startup. INDEE Medical has the exclusive license to develop and sell the product in Japan, and achieved a successful exit within just 38 months of its launch. In this startup interview, we sat down with founding members Akihiko Shimauchi (former president and representative director) and Shingo Tsuda (former director) to learn about what led to their encounter with ReCell, the exit, and key points to their success

Negotiating for development rights and investment was pursued while in the virtual company stage

ReCell creates a cell suspension from skin obtained from a patient, then sprays this on the affected area to treat burns and wounds and aid in regeneration. This is a technique developed by AVITA Medical in Australia. How did you find this technology and seek to obtain the exclusive development and commercial rights in Japan? Could you also tell us more about how you two met and other backstories behind the company

Shimauchi I happened to learn about ReCell around 2011, when I was handling the Southeast Asian market for a bio company. The product was exceedingly interesting, so I contacted Avita, and they said that they were interested in selling the product in Japan. So, I proposed to the upper management of the company the idea of obtaining distributor rights for ReCell. While the product in some way competed with our own, I felt it would create synergy if handled correctly. However, the company was against the idea. For some time, I kept the idea of ReCell tucked away in the back of my mind.

Tsuda My company, INDEE Japan, acts as a seed accelerator and supports firms launching new ventures. I met Mr. Shimauchi at an event where those involved in regenerative medicine got together to exchange ideas and opinions. Given his experience in both the startup world and pharmaceuticals, we hired him as an advisor. As I discussed with him about what innovative new technologies there might be to bring to the Japanese market, he told me about ReCell. ReCell has excellent performance as a product, and we were intrigued by its potential, so we obtained the commercial rights and resolved to form a new company together. We began negotiations with Avita in 2013.

Shimauchi Prior to that, I was headhunted to serve as a president of a pharmaceuticals startup, and we got up to an IPO, but during the final decision stages, I was obligated to comply with the majority opinion of the founders and leading shareholders, which left me with some regrets. I then assisted two biotech firms, but I still strongly wanted to be involved on the ground floor as a founder, president, and chief shareholder of a venture that would let make good on those earlier aspirations. At around that time, I met with the people at INDEE Japan and, given renewed interest in the regenerative medicine, I decided to throw my hat in the ring again. We had five founding members, and were joined by two others, which set the project in motion.

Tsuda In the early days, there were many things still up in the air: whether we would be able to ink a contract with Avita, and whether the business would be viable in Japan. Therefore, instead of launching the company from the ground up, we ran it as a virtual concern for some time.

-- What exactly do you mean when you say "virtual?"

Tsuda Raising funding to establish a company would increase the burn rate (the capital needed to operate a business for a given month). Instead, we pursued negotiations with Avita and discussed possible venture capital infusions while still in a virtual state.

Shimauchi At the time, Avita was emphasizing the Chinese market and had some financial constraints, so they were hesitant to enter the Japanese market. While the CEO of their company was on a business trip to China, we approached them with this offer: "If you grant us the exclusive development and commercial rights in Japan, we will raise the necessary capital to build the business in Japan from venture capitalists. You will be able to enter the Japanese market at no risk and not pay a cent. You'll never find a better offer. We have our own financial constraints, so we cannot pay an upfront fee, but you can leave the rest to us." They were intrigued by our enthusiasm and alacrity, so the deal went forward. During the negotiations, our company name was still not finalized, so the name on the final draft of the contract was set as "TBD." The Avita CEO said, "This is the first time I've negotiated and inked a deal with a virtual company!" (laughs)

Tsuda We brainstormed a company name with the team and were ready to move forward, but another startup beat us to the punch by a hair's breadth. Comping up with a new name from scratch would have been time-consuming, so we simply took part of the name from INDEE Japan and called the company INDEE Medical. (laughs) INDEE Medical was formally established in January 4, 2016, and we concluded a formal agreement with Avita the next day. The first general meeting of shareholders was held at NihonbashiLife Science Building.

ReCell, a skin regeneration technique drawing the attention of academic societies

--We would like to ask you a bit more in detail about ReCell: what potential do you see in terms of what ReCell has to offer?

Shimauchi ReCell is a completely new regeneration technique for skin. Ordinarily, a skin culture takes several weeks. ReCell, however, utilizes a patient's own regeneration functions, obtaining skin cells, dividing these, and then creating a cell suspension, with no culture necessary. Between just 30 minutes to one hour, a cell suspension can be created. This is sprayed onto the affected area to help heal burns and wounds. This suspension can be expanded to 80 times the area of the site of extraction, so the patient's own cells can be used with little burden on the patient and with no risk of rejection. This greatly improves the life-saving rate of severe burn treatment and allows the skin to heal with minimal scarring. The mechanism of action is extremely simple and clear, and many doctors have referred to it as an "Egg of Columbus."

Moreover, this technique can be used for conditions other than burns. Initially, it was believed to only be applicable to burns, but papers in the US suggested ample evidence that it could also be used for repairing the skin in conditions like acute and chronic wounds, vitiligo, scars, ulcers, birthmarks, and more. We could strongly tell that the product had market potential beyond what we originally envisioned. The date on which we finalized the basic agreement with the Avita CEO was also the deadline for filing to exhibit at BioJapan 2015; we filed straight from China. The numerous attendees at the event asked us about the possibility of using it for vitiligo or old scars they and their family members had. With this much interest, we felt confident that ReCell could help with many unmet needs.

Tsuda Traditionally, the mechanism used for skin treatment is gradually blocking the periphery around an injured area in order to aid with healing. With ReCell, however, a cellsuspension is applied evenly across the entirety of the wounded region, making for very rapid skin regeneration and curbing the formation of scars to the maximum extent possible. This makes it excellent at rectifying the skin appearance in a uniform manner. This is the major, essential value offered by the technology and intrigued us so much. INDEE Medical is founded on the idea of innovative care and quality of outcomes, and we believe that this quality of outcomes can help patients more quickly heal and reintegrate into society, as well as restore their self-esteem, something many people seek.

--So what did you list as the applicable conditions when making the pharmaceutical filing?

Tsuda It is being filed for under "all forms of skin repair, including burns and vitiligo." We are aware of the many restrictions inherent in Japanese pharmaceutical legislation, but there is major demand from patients and the general public, and doctors are enthusiastic about the product, so we resolved to approach it as a treatment for all forms of skin condition.

Shimauchi The product is currently in the review stage, so we cannot go into the particulars, but we were able to get feedback from the Pharmaceuticals and Medical Devices Agency in advance and gain a variety of useful advice. Through these consultations, PMDA seemed keenly aware of getting this product on the market as soon as possible as a new technology poised to contribute to the standard of medical care.

In addition to the medical benefits, ReCell also excels in terms of the cost performance; by making in-hospital treatment time much shorter, it cuts down on medical costs. A health economic analysis funded by the US government reported at the American Burn Association that several billions of yen were saved in medical costs at a major burn treatment center. The materials costs are also a tenth of traditional regenerative medicine treatments, leading to a major expense overhaul; this solution also helps hospital bed turnover and gets patients healthy and integrated back into the workforce for productivity gains, so it has a major downstream economic effect.

A carefully prepared exit plan

--So INDEE Medical developed ReCell into a product with a higher profile, and succeeded in exiting the startup on February 28th of this year. Why did you opt for being acquired through an M&A and transfer of shares, instead of an IPO? And did you struggle to find a buyer?

Shimauchi Since its founding, INDEE Medical by design set M&A as its approach to an exit plan. IPOs tend to be the norm in Japan, but the US usually adopts M&A exit strategies. I had strongly felt for some time that successful M&A would be necessary to contribute to the growth of the biotechs,. Compared to an IPO, an M&A outcome has a lower return, but you can move the business forward with a smaller team and exit in a shorter timeframe. Our goal was to exit within 30 months. IPOs tend to take 5-10 years. I was already 69 at the time we founded the startup, so, to be honest, I wanted to exit early and start enjoying my retirement. (laughs)

We considered a wide range of possible buyers and moved the negotiations forward with existing pharmaceutical manufacturers, medical device manufacturers, startups looking to expand their pipelines, major pharmaceutical distributors, firms from other sectors looking to enter the healthcare segment, and so on. Fortunately, there is major interest in the regenerative medicine, and the stock market is sensitive to new approaches, so we garnered strong interest from many companies.

Tsuda The market mechanisms at play in the healthcare sector are quite complex. We did not simply acquire a product and technology from Avita and then hand it off to the highest bidder. The M&A was a success because we carefully took into account the needs of hospitals, doctors, and patients -- that is to say, the market -- needing ReCell and found ways to maximize its value.

Shimauchi We actively took part in preparing for the pharmaceutical filing and reporting our findings to academic societies in order to enhance the value of the business. Two of our founding members are experts in pharmaceutical affairs, and we made effective use of CROs to arrange all relevant filing documents on our end and allow for the buyer to proceed with the filing without missing a beat. For this M&A, we inked the contract for the sale of the business and made the pharmaceutical filing on the same day.

This was owed to the fact that we made the filing arrangements in advance and pursued them in tandem with our activities at academic societies. What gave us a real push was the American Burn Association describing it as "one of the most groundbreaking burn treatments in the last several decades." This led to increased interest from the Japan Society for Burn Injuries, with a symposium with a doctor from overseas having a full house. This symposium reported on clinical trials in the US and on the high life-saving rate of the product in the context of compassionate use for those with severe burns. ReCell was also used on over 60 victims of the Taiwan water park explosion. Today, many doctors with the Japan Society for Burn Injuries are familiar with the name ReCell and INDEE Medical.

We introduced the product to the Japan Society for Surgical Wound Care, Japan Society of Plastic and Reconstructive Surgery, Japanese Society of Limb Salvage & Podiatric Medicine, and the Japanese Society of Pressure Ulcers are as a means of skin repair, and we garnered strong interest and demand for early approval.

We ultimately sold the shares to Cosmotec, which is engaged in sales of medical devices and is a subsidiary of M3, Inc., a company involved in dissemination of medical information and marketing support services for the pharmaceutical and other industries. M3 has pursued a range of Internet services and what it calls "ex real operations" in the realm of advanced medical care, and now it is actively investing in this new technology as a third lever to growth. ReCell is a hot new topic and a good fit for their strategy.

Shimauchi While we did exit in 38 months, our original goal was 30. We had actually gotten just up to the point of closing a deal with another firm, but the negotiations failed. That means we brokered the deal with M3 in just eight months after making contact. I myself was amazed at their alacrity and speed, something you don't find at the traditional, larger firms. One thing we found disappointing with many of the firms we approached was that, while middle management tended to be actively interested, the conversation would stall once reaching upper management beyond them. In spite of the fact that this was a new venture, so it would only stand to reason that the marketability of the product was an unknown, they replied that the company had no proven performance to show for it, so were reluctant to give the go sign. This really gave us a sense of why innovation fails to occur in Japan.

--As an organization grows in size and scale, it adds layers to the decision-making process.

Tsuda One theory says that companies have an average life expectancy of thirty years. That being as it may, existing organizations could remain relevant by staying attuned to the times. When it comes to people creating something from scratch, it's entrepreneurs like Mr. Shimauchi who drive that change. Larger organizations have people like that in their ranks, so they should subdivide and spin off as needed to bring that talent to the fore, and give those people authority as presidents of their respective business units.

The secret to success -- what can other entrepreneurs learn from this?

--Looking back, what do you think were the key points to making this venture a success?

津田 Firstly, there was sort of "gentlemen's agreement" entered into between the founding members; it was something Mr. Shimauchi created prior to founding the company. It proved exceedingly useful in getting all members aligned on the same vector at this startup, even despite coming from diverse backgrounds. I strongly encourage other entrepreneurs to adopt this method. The agreement described the ideal exit strategy, the corporate culture, the allocation of shares after establishment, and the allocation of expenses prior to establishment. It was a simple, one-and-a-half page document that concisely summarized these details, with all members signing off on it.

Shimauchi This document merely listed quite commonplace agreements that are usually made, but having this to turn to ensured that we never came to blows when it came to money matters. (laughs)

Tsuda For example, we could turn to this document to see exactly who would be responsible for travel expenses when heading off to negotiate for the development rights with Avita, so we didn't get bogged down in the particulars. The agreement stipulated in advance that travel expenses would be divided among us, so no one was bothered by it. Building up that culture and understanding is key.

Shimauchi Some of it may have had to do with the affinity Avita, M3, and INDEE Medical had as similarly-minded concerns. All three are entrepreneurial ventures. We could flexibly call a counterparty and then head off to Beijing or Hong Kong to meet them the next day. They were open to our enthusiasm and had a similar sense of speed about the decision-making process.

Personally, since my last position was at a competing manufacturer, I felt compelled to disclose my working on ReCell and obtained their consent. It was not exactly a formal procedure or obligation, but this is a small industry, so I think paying respect to the other people in the room is important.

Tsuda Another thing to note, and this is unique to Mr. Shimauchi's approach, is that the preparations were done with exceeding care, which helped secure our success. It's essential to keep in mind that things may not go according to plan at a startup, so you must make due preparation for all outcomes you can possibly forecast. By formulating these different scenarios, if the inevitable should occur, then you can accommodate it per your plan. Innovators are constantly interested in new challenges and may tend to overlook preparing the necessary documents or risk hedging, but we learned that developing that mindset of preparation, no matter how obvious it may seem, is key.

Shimauchi Be it an IPO or M&A, due diligence will be performed. Therefore, even prior to founding the company, we kept that in mind -- making those preparations is key. The way documents are prepared, the way they are filed and organized, and the quality thereof reflects the reliability and reputation of a firm. Creating documents properly so as to lend peace of mind to the buyer and the securities broker should always be kept in mind.

--For our part at LINK-J, we are thrilled to see that this is the third exit out of the Life Science Building. Allow us to offer you our utmost congratulations. Could you please share with us any expectations or requests you have for LINK-J going forward?

Shimauchi We are very grateful to LINK-J for creating opportunities for those in the life sciences to meet and interact. I started to work at Chordia Therapeutics as an auditorafter the president of that company had attendedmy lecture hosted by LINK-J.as Also, networking held here is great help for us. I would like to continue sharing my experiences with the next generation and to support those actively taking on new challenges.

Tsuda I have been involved with LINK-J since its founding three years ago, and also have enjoyed their support when launching INDEE Medical, and for the launch of the ZENTECH DOJO Nihonbashi, an initiative to support prospective entrepreneurs. It really feels like we are growing in tandem with LINK-J. A properly functioning ecosystem is essential to the ongoing growth of the life sciences sector. In that sense, we hope this will serve as an opportunity for the experience of entrepreneurs everywhere to further inspire up-and-coming entrepreneurs. I personally find this program to be a continuous source of inspiration, and I hope to continue having that opportunity to learn.

Akihiko Shimaucih, INDEE Medical advisor and founder

Akihiko Shimaucih, INDEE Medical advisor and founderAfter graduating from the Waseda University School of Education, launched new business segments at various life sciences firms within and without Japan, as well as helped restructure divisions that were posting poor performance. Became involved with bio ventures in 2005. Since that time, has served as representative director, advisor, and other roles at bio firms. Launched INDEE Medical in 2016 as a venture seeking to create commercial products around regenerative medicine. Recently assumed the position of auditor of Chordia Therapeutics, a bioventure spun out from Takeda Pharmaceutical Company

Shinga Tsuda, INDEE Japan president and technical director

Shinga Tsuda, INDEE Japan president and technical directorAfter working at IBM Japan, Hitachi Global Storage Technologies, and iTiD Consulting, founded INDEE Japan with a focus on fostering innovation. When working in hard disk drive development as an engineer, became intrigued by the book "The Innovator's Dilemma," and resolved to pursue the path of innovation. Partnered with Innosight, an American company founded by Clayton Christensen, author of the above book, and acting as its Japanese partner to build a global network and support startups and in-house ventures by major firms.