The key value of biotech startups lies not only in achieving short-term performance, but also showing mid- and long-term growth potential through specific products or services. In recent years, the Japanese market has joined a global shift towards a creation of better methods for appraising these startups.

Moreover, creating startups and attracting their investment to international investor and major companies on the global stage, and activating the bio ecosystem are required for the industry. Therefore, we are having an interview with venture capitalist Atsushi Usami and biotech startups analyst Hironoshin Nomura to further discuss these and other issues.

Overwhelming number of private investors in bio stocks

―― This dialogue was achieved through the reference of Mr. Usami, a supporter of LINK-J. Could we begin with a brief introduction?

Usami I work in the life sciences division of UTEC, a venture capital firm that invests in the development of domestic and foreign universities and research institutions including the university of Tokyo. I joined UTEC because I wanted to be involved in the creation of companies that are valued globally for solving issues faced by humanity. In addition to investment and management support, I also work with researchers in the pre-founding stages and entrepreneurial candidates to help them co-found new startups. When I was a student I majored in pharmacy and obtained a doctorate. After graduating, I have assumed a position at a think tank. This is now my seventh year working with UTEC. Wanting to hear more from Mr. Nomura, who plays a central role in revising the listing and de-listing standards for upfront investment startups (biotech startups included) in emerging markets in Japan, I arranged for this discussion.

Nomura I am also a graduate of pharmaceutical sciences, and I largely engaged in bio-oriented research as a student. After graduating, I was involved in the acquisition of pharmaceutical companies and launching of new business at a think tank; looking to specialize further, I took a position as an analyst specializing in the biotech field at Mizuho Securities. I spend my days preparing analysis reports that help institutional investors in investing in bio firms.

Usami There are few venture capitalists specializing in the bio field, but there are even fewer biotech analysts in Japan.

Nomura In terms of analysts not focusing on major pharmaceutical companies and only biotech startups, it's 2-3 people in the entire industry.

Usami It is necessary to announce to upcoming students that there are other careers on the periphery of pharmaceutical companies and academia where they can put their background to use.

Nomura Yes, that's right. One reason for the lack of bio analysts is the limited number of public biotech startups in Japan and their scale, and the private investment dominates this market With private investment, share prices don't tend to reach a fair market value that takes into account mid- and long-term growth prospects, so institutional investors avoid these sorts of stocks. Furthermore, institutional investors have specific fund rules, such as only investing a company on the first section of the Tokyo Stock Exchange that is drawing a profit. They cannot just freely invest in anything. However, the total market capitalization of public biotech startups has reached approximately 2 trillion JPY, so institutional investors cannot ignore this. We'll likely need more and more dedicated analysts for this field going forward.

Atsushi Usami (Partner, The University of Tokyo Edge Capital Partners Co., Ltd. )

――Generally speaking, a venture exits either through an IPO or M&A. Japan seems to be much more strongly IPO oriented. However, some feel that M&A is a worthwhile consideration to make, given that IPOs carry incidental costs. What is your opinion, Mr. Usami?

Usami My thoughts are that whether you opt for IPO or M&A, taking any route so long as it leads to your product or service getting a foothold in the market and maximizing its value is key. Furthermore, it's a case-by-case issue depending on the type of technology, the preferences of stakeholders, the ability of financing, and so on. That being said, there are still few IPOs in Japan, but there are even fewer M&As. In the US, large-scale IPOs get reported on frequently, but in Europe, M&A is much more the norm. For example, when I recently visited EPFL in Switzerland, with its world-renowned reputation for academic research, there was an incubation facility in campus which members are the academia, venture capitalists, major pharmaceutical companies, seed manufacturers, and other stakeholders. They have communication on a daily basis and this apparently leads to quite active M&A operations, albeit on a smaller scale. This day-to-day exchange of feedback about what each venture needs and what industry standards to pursue is vitalizing the industry there, not just in terms of M&A. If Japan could pursue this sort of open innovation and co-creation more, we would have more options at our disposal and the situation will be changed.

――As an analyst, your main concern is the value of a venture after it goes public. When you review startups prior to their listing, what do you think about the importance on the extent of VC backing they have?

Nomura In the US, with its comparatively longer history in this area, the extent of VC investment prior to a public listing is very important factor. Perhaps Japan is newer to the game, so it is not emphasized as much. Also, in the US, there is an ecosystem which people know who are the entrepreneurs, venture capitalists, and institutional investors, so there is a feedback loop of people, things, funds, and information going around. You can look to a venture and if a certain someone is investing in it, you know it has to be a first-rate operation and there is no problem to obtaining patent. I think Japan will eventually reach this point.

Revising listing standards towards sound market growth

――We'd like to ask you a bit about the revisions to the listing and delisting standards for biotech startups on the Mothers section of the TSE. Could you tell us about the background and what the key points of these revamped standards are?

Nomura The Ministry of Economy, Trade, and Industry which has awareness of the issues launched the "Meeting to promote dialogue between biotech startups and investors" in 2017. I was invited to this meeting. I have always tended to advocate that achieving a successful biotech startups requires taking steps prior to the IPO, but equally important is having a market that is equipped to fairly assess the value at the IPO and thereafter. I think this is likely why I was invited to take part. The majority opinion in this discussion was that it is unreasonable to strictly apply the existing seven criteria for listing. Also, an explanatory paper clarifying a new approach towards flexibility was released. The delisting criteria were also revised, as the prevailing method of delisting startups based on short-term performance seemed inconsistent. However, this discussion is essentially broader one not just about the bio sector, but about how to handle emerging markets as a whole. So, we need to continue discussing the listing and delisting criteria in tandem.

Usami What was the main takeaway for you?

Nomura Personally, I think it became more clear that alliances with pharmaceutical companies are not a must-have for IPOs. If these alliances as essential to an IPO, then the venture has less bargaining power against the pharmaceutical company, leading to concluding a contract of lesser value. When that occurs, even if they exit with an IPO, the mid- to long-term growth prospects are less stable. From the perspective of the pharmaceutical company, a venture with which an easy alliance can be brokered or the chief products of which are already in alliance with another company is less likely to be targeted for M&A. What is your take as a venture capitalist on the new revisions?

Usami More concretely sharing company evaluation criteria will clarify which has remained a gray area thus far. I am involved from the seed and early stages -- you find researchers and entrepreneurs who do not have a concrete image of how to formalize the business or evaluate it. Clarifying not just the value of the technology, but disclosing to potential investors what points of view there are underlying the value assessment, how the organization is internally structured and developed, and so on allows for taking stock of the future soon after the venture is founded and aligning your trajectory with stakeholders. This in turn helps growth and preparing for a public sale. Also, setting the right indicators helps improve fundraising and foster investment from institutional investors within and without the country, which in turn should lead to more companies being poised to grow their businesses in major ways even after an IPO.

Hironoshin Nomura(Senior analyst, equity research division, Mizuho Securities)

Fostering a community to help the industry as a whole grow?

――In addition to revising the standards for listing a company, what sort of context do you think is needed today in order to ensure that the worth of biotech startups is properly evaluated?

Usami If we see more investment from "crossover investors" as in the US, where investment is made from before a company goes public on through to after listing, I think conditions here will change.

Nomura I agree. With crossover investors, you have two types: ones where a VC retains their shares after the IPO and continues investing, and ones where an institutional investor invests in the company prior to its listing. I believe Japan needs both of these approaches.

Usami I think going forward we will see growing interest in forming VC funds and soliciting overseas investment such that you get sustained, meaningful investment at a considerable scale not just in the seed and early stages, but in the middle and late stages. We will likely see a push for this in terms of VC enhancing the value and performance of these assets.

Nomura For institutional investors and business operators, the creation of a bio index would be quite meaningful. I would add that we need more raw numbers of analysts to disseminate information to institutional investors.

Usami I hear some people express misgivings about the volume and quality of information disclosed by startups. As better disclosure becomes the norm, it will lead to better value assessments. Third party evaluations are also important. In the past, it was not unusual for there not to be enough eyes on a particular industry in terms of numerous scientists or experts reviewing it, and a fair share of companies were managed like family businesses. Having more third parties reviewing the research and development and management of these companies will lead to their corporate value improving in a more streamlined fashion.

――Lastly, please let us know if you have any expectations for the future of LINK-J.

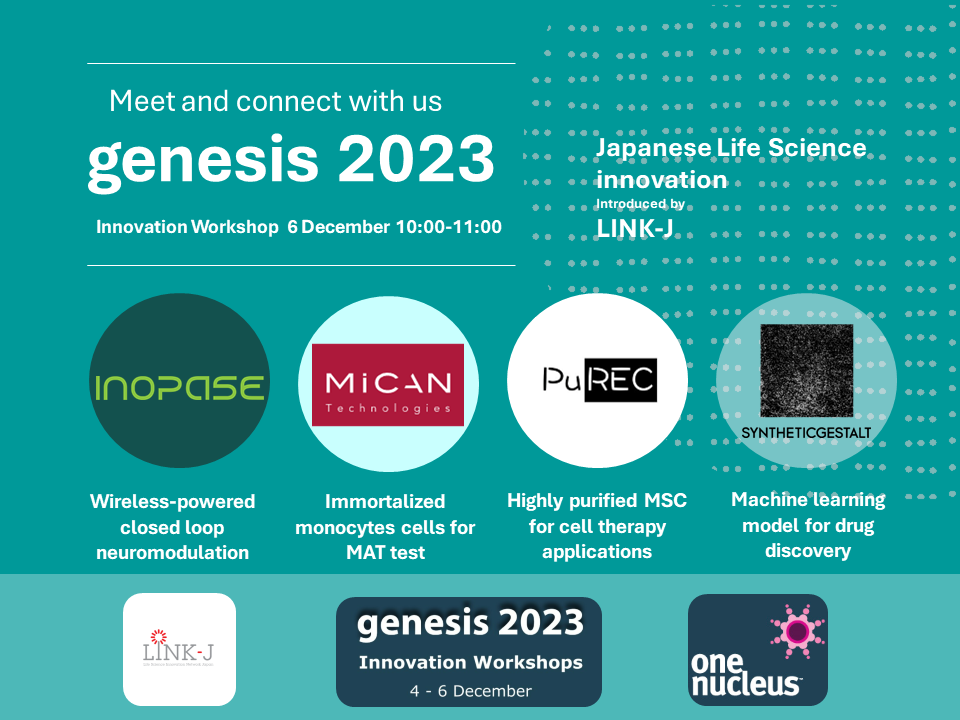

Nomura LINK-J's attempt to create an ecosystem is truly inspiring -- I mean it. I've taken part in several LINK-J events in order to research companies in the pre-listing stages. It might be more interesting to invite institutional investors in terms of building up the community, too. It would be great if LINK-J played a role as a go-between virtually linking the 6-7 biotech clusters around Japan, to act as a sort of hotline that overseas pharmaceutical companies and investors could reach out to when wanting to contact a cluster in Japan.

Usami In the US and elsewhere, they hold large-scale events specifically for the advanced bio sector where academics, members of startups, investors, analysts, the media, and other key players come together to share information, as well as case studies on successes and failures. It might be interesting for LINK-J to host such an event in Japan. With over 450 members, it could usher in major change.

Nomura Yes, we are definitely at a point in time where we have to ramp up the sector as a whole. The goal should be getting diverse people to exchange ideas and information and create a context where people within the industry are helping each other.

――We will continue doing our part to help foster a community that gives back to the industry. Thank you for your time today.

Atsushi Usami LINK-J Supporter / Partner, The University of Tokyo Edge Capital Partners Co, Ltd.

Atsushi Usami LINK-J Supporter / Partner, The University of Tokyo Edge Capital Partners Co, Ltd. Atsushi Usami studied pharmacology and neuroscience and received a Ph.D. In pharmaceutical sciences from the University of Tokyo and is a pharmacist.He focuses on seed/early-stage life science investments. He currently serves on the boards of Repertoire Genesis Inc., Goryo Chemical Inc., EditForce Inc., MiRTel Co. Ltd., Epigeneron Inc., Bugworks Research inc., bitBiome Inc., and OriCiro Genomics, Inc. He is a JST START promotor and a NEDO TCP mentor. He teaches seminar on industry-academia collaboration at colloquiums in the Graduate Program for Leader in Life Innovation at the University of Tokyo. Before joining UTEC, he worked as a strategy consultant at Mitsubishi Research Institute (MRI), serving pharmaceutical, medical device and other manufacturing companies across a range of areas including mid-to-long term management planning and new business development.

Hironoshin Nomura Senior analyst, equity research division, Mizuho Securitie

Hironoshin Nomura Senior analyst, equity research division, Mizuho SecuritieA graduate of the Graduate School of Pharmaceutical Sciences, majoring in biopharmaceuticals. Following a position at the Mitsubishi Research Institute, assumed his current position in 2015. Ranked as #1 for stock selection in the 2016 Thomson Reuters Analyst Award, #9 for pharmaceutical/healthcare products in the 2019 Nikkei Veritas Analyst Ranking (placed #1 in the bio category), and #4 for the 2019 Institutional Investor Biotechnology & Pharmaceuticals ranking (placed #1 in the bio category). Actively takes part in panels of experts such as the Ministry of Economy, Trade, and Industry's "Meeting to promote dialogue between biotech startups and investors," ongoing since 2017.